The Cooldown- Is the Sky Falling?

You may have seen the articles talking about the market cooldown that has been happening in our region… some more sensational than others. But, it’s all relative. While it is true that this is the slowest the market has been for the last 3 years, it is not the end of the world.

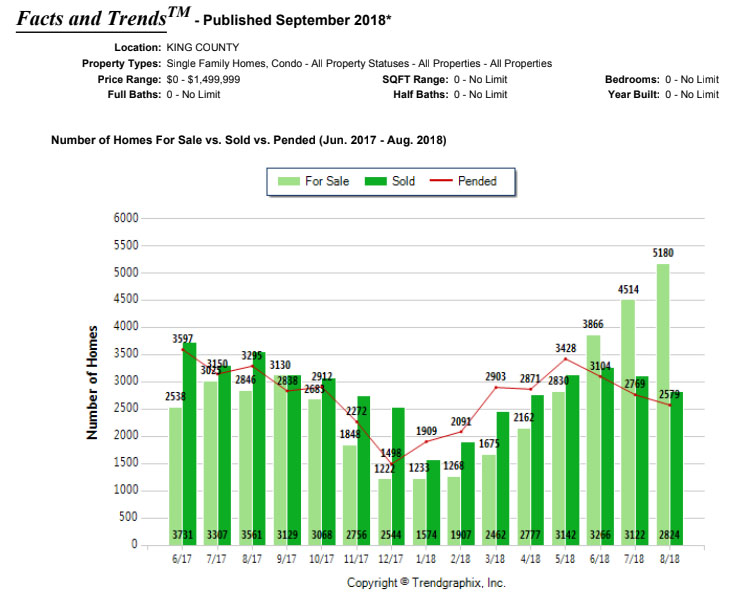

First, lets’s look at the data. The graph below shows the sudden increase in inventory. As of June, we entered a period where the number of homes for sale suddenly and dramatically increased over the number of homes sold. This followed a period where, since January, the number of homes going pending was far above the number of homes sold, which indicates that the inventory was being eaten up.

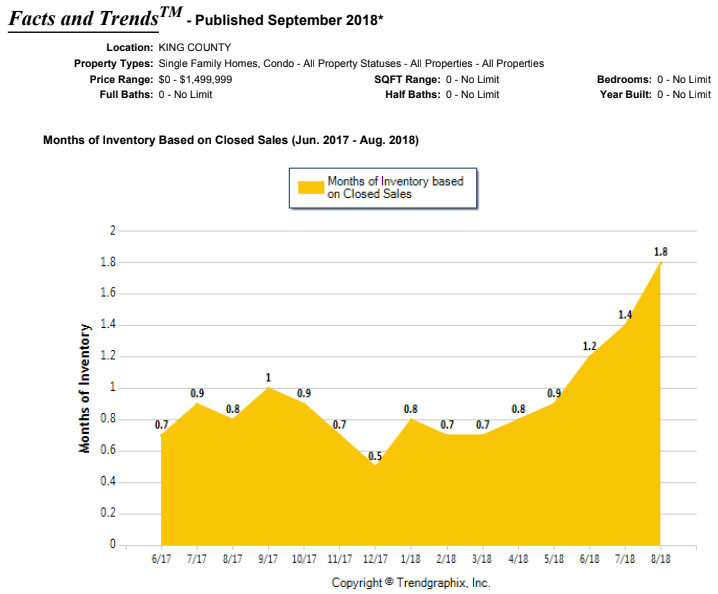

This graph looks scary enough to write a sensational headline, right? Now check out this graph of the inventory spike.

Also a pretty horrifying spike, there. This is a graph for King County as a whole. Specifically in Seattle, this is the first time that we have had over 1 month of inventory in 3 YEARS!

But, this is only part of the picture. The fact is, even this spike is WAY below what is considered a “balanced market.” Ideally, a market that puts buyers and sellers on an even footing would be around 5 months of inventory. As you can see, we’ve got a way to go before we hit that mark.

So why all the sensational headlines? Relatively speaking, this market feels incredibly slow. Until recently, sellers could list anything at a vaguely realistic number and expect to get at least one offer within a week. More often than not, property would be listed at a somewhat reasonable price, but would attract a hoard of buyers like moths to a flame. The competition would be fierce and the escalations in price would be extreme. My personal record was a home that I sold for $133,000 over my list price. No appraiser in their right mind would have let that slide, but the buyer paid all cash and had no contingencies, so the deal went forward. When this sort of thing happens every day, we all get used to it, and home values as a whole start rapidly increasing. Sellers started expecting that they could sell anything for a massive escalation, by simply listing it, regardless of price.

So what happened? Among my colleagues, we’ve discussed many possible reasons for the sudden change. It’s a combination of rising interest rates putting the squeeze on buyer budgets, the sudden increase in inventory that is apparent in the graphs from above, and a healthy dose of Buyer’s fatigue. I also believe that market timing has contributed.

From January until May, sellers were watching prices skyrocket and were ready to get in on the action. Knowing that the hottest season for buyers historically starts when school ends, they took their time to prepare for their home sale, and tried to time it for a June listing. In this period, sellers were ready to go, but were sitting on their property until they could capture the most buyers and win one of those hefty escalations. Inventory stagnates at an extremely low point for these few months, further frustrating buyers with a lack of listings to choose from, and an excess of competition for the ones that are available. June rolls around, and the market is “flooded” with more listings, which would hopefully be a boon to the market activity. Unfortunately, right around that time, the Fed raised interest rates for the third time this year. Buyers that were struggling with what little inventory was available up until that point, now had a harder time qualifying for the homes that were suddenly available. Assuming that they were knocked out of the competition, or feeling like they simply didn’t want to deal with the hot season buying frenzy, the buyers backed off. More inventory floods in, but the buyer fatigue is still in the air.

For June, it felt like the floor had fallen out on sellers, but the market had really just cooled off a bit. Buyers that were still out there were suddenly winning offers with inspection contingencies and no escalations! Some sellers increased their list prices because they had tried listing below market value to attract attention, only to get one offer at their list price. The old strategies weren’t working as well anymore.

Currently, the buyers that are still actively looking, are snagging some deals that feel incredible compared to what they were expecting leading up to the “hot season.” I have encouraged a few of my own buyers to get off the bench for this moment.

Competition and escalations are still out there. Sellers are still selling for high prices. It’s just that buyers can afford to be a little more picky right now. Personally, it’s been a welcome reprieve to my business. I get to do more data analysis and strategizing with my sellers, and I get more negotiating room for my buyers.

So, while it’s true that we are in a slower period, we still have a long ways to go before we can call it a crash. Housing shouldn’t be looked at as a commodity, either. Real estate is historically a very stable investment that, at its absolute worst, will still beat inflation over the long-term. Maybe the flippers and speculators are backing off due to the uncertainty month-to-month, but the smart buyers looking for long-term stability and the smart sellers sitting on a mountain of equity are still out there making the deals happen. As long as we have both, the market is still going to keep moving.