ikerivelle

Posts by :

Pay Your Mortgage Off Early or Invest Extra Cash

Which Strategy is Right For You?

The Right Strategy for your Situation

As time marches on, your financial situation will likely improve. You might receive raises, bonuses, inheritance, or start working a new and better job. Maybe you have more than you need to purchase a new home. Maybe you already own your home, and now you are earning much more than you need to pay your mortgage and other expenses.

Eventually you may find yourself with a surplus of savings or income. When that happens, you will be faced with a decision about what to do with with the extra cash. Do you pay your mortgage off faster or earlier than expected, or do you pay a minimal mortgage payment and invest your surplus elsewhere? The answer to that question will depend heavily on your own personal situation.

There is no right or wrong answer to the question. You should consider both options, or a combination of both options, through the filter of your own personal goals.

Pay It Off Early

If your goal is stability, you may be leaning towards paying it off early. Nobody likes debt, so the less you have, the better. Pouring extra money into paying off a mortgage shortens the horizon of when the loan can be paid off in full, and you can own all of the equity in your home outright. Even before that happens, you can rest easier knowing that more of your money is going right back into your own pocket in the form of equity, rather than into the hands of your lender, in the form of principal and interest payments. Down the road, you can leverage that equity into home improvements or other investments, by borrowing against it, or refinancing.

More equity and less debt are very tempting goals to work towards, but they may not be YOUR goals. Ask yourself if what you want is the extra equity, or extra stability.

Owning a home outright, or simply owning more equity in your home helps you in the event of financial hardship or a market downturn. If you lose your job or otherwise can’t work, knowing you don’t need to worry about the worst-case scenario of losing your home or being underwater on your mortgage can be a relief. You also don’t want to be paying a mortgage you can’t afford, after you retire. Less financial stress is a valuable asset, but it is an intangible asset that is hard to quantify.

Over the course of your mortgage, paying more saves you the cost of interest, but that can be a trap, depending on your goals. Paying more to avoid future interest payments is taking money out of your pocket now to save for the future. Mortgage payments amortize to pay off more interest in the beginning of the loan, rather than at the end. The bank always gets theirs first. Paying more reduces your principal payment, which lowers the basis on which your interest is assessed, so it will lower your interest payments as you go. However, the savings can be negligible, especially in the beginning of your mortgage term, when your principal balance is still very high. So, if you are planning to sell your home before your mortgage term is up, you should take the time to calculate your anticipated savings to see if you are really making enough of an impact to be worth the effort. With low interest rates, it may make more sense to put that surplus elsewhere. As interest rates go up, aggressively paying down your loan may make more sense, to keep your interest payment from taking such a big bite, in the long run.

Likewise, doing it to capture more equity might not be as helpful as you expect. While you do own more of your investment with each payment of principal, you are essentially converting your liquid asset (cash) into your illiquid investment (home equity). The only way that equity can be utilized in the future would be to either sell your home or borrow against it through refinancing or lines of credit. You can’t ask your lender to pay you back. Also, those extra payments do not compound your investment. Your home will increase in value at the same pace, whether you pay more into the mortgage or not. The only thing you are changing is how much you will get back into your pocket when that equity is realized after a sale, or if you borrow it again. The extra principal is a 1:1 ROI. In other words, if you pay an extra $10,000 towards your principal, you only get that exact $10,000 back when you sell the home, along with the amount realized from how much more you sell your home above what you paid for it, which is your actual profit. You’ve essentially just saved that money, at 0% interest. With inflation, that extra principal payment is technically losing value.

However, if the home we are talking about is your dream home, and you plan to hold it and live in it for the rest of your life, it might be worth trying to pay it down faster. A mortgage is basically just a delayed payment system granting early ownership of an asset, along with all associated benefits. Remember that you are using it to buy something of value. So, if your interest is in owning the home itself, paying more of your mortgage accelerates when you can claim full ownership, and does significantly lower the interest paid over the long term. Even after you’ve paid off all debt associated with a home, it still functions as a worthwhile asset, because its value will continue to increase even after the mortgage is paid. Also, being able to pass this free and clear asset on to other family members, or rent it to somebody else, can provide a lot of extra income to you and/or stability to somebody else. Stability is not an easily quantifiable benefit, but a valuable one, nonetheless. Owning your home is power to control and provide space and shelter on your own terms.

Another reason you may choose to pay it down faster, is because you know you will be making less in the future. By owing less on the home, you can refinance the mortgage for a much lower principal base, which could lower your monthly payments, even if rates increase. But, if you happen to be saving money elsewhere, you can get the same affect from bringing a large down payment to the table, when you refinance.

First time home buyers with access to decent interest rates should heed this advice. If you are purchasing a starter home that you later intend to exchange for a better one, perhaps you should stick to the minimum mortgage payment, and let the market elevate your investment for you. In the end, you will realize the modest amount of principal you’ve paid down PLUS however much the property has increased in value under your ownership. Putting extra money into improving your property will be more valuable than trying to aggressively pay down your mortgage. Value increases tend to out-pace the speed at which you can pay off your mortgage, and fixing your home boosts that appreciation. It also makes it easier to sell, when the time comes. Only paying the minimum on your first home should provide you with a much stronger down payment for the next home, after you realize your appreciated value. Even if interest rates increase, that can still help you lock in a lower monthly payment on your next, better investment, when the loan is originated. If that next home is your dream home, then crunch the numbers to see if a more aggressive mortgage payment is worth the effort.

Investing Your Surplus

If paying more into your mortgage doesn’t actually align with your goals, then you are likely more interested in how real estate works as an investment. In that case, you should let your real estate investment grow, and allocate your surplus resources to other investments.

The main problem with the scenarios I outlined in the previous part was that the money paid into your mortgage is not compounding your investment, so it’s not working for you as much as it could. In contrast, investing in something like stocks can yield the benefits you seek. Each purchase of stock increases and compounds your ownership equity. As those businesses grow and the stock value increases, so does the value of the money you put towards that investment. More money in the investment ideally yields more earned on that investment.

Obviously having your money work for you is the better call if you want more money. Why not just rent forever, and throw all of your money into the stock market? Risk and volatility are why not.

Investing in a home is a relatively stable investment. While the lack of liquidity in that investment can be a frustration, it can also be a godsend. If you own your home, and the news tells you that home prices are stagnating, you may worry a bit, but you don’t panic, tell the family to start packing, and throw up a for sale sign. You do nothing, confident that real estate is a historically safe and stable investment that will hedge inflation, at the very least. Maybe you call your real estate agent for their read on what’s happening, but that’s it. You are in it long-term, so the day to day price fluctuations don’t really affect you. You know your home is valuable and will pay off in the end, even if you don’t know its exact value in that exact moment.

The stock market can be much more tricky to navigate, psychologically. If you own shares in a company, you know that each of your shares is identical in value to everybody else’s shares. You can also watch a ticker tell you, in real time, what that share is worth, as determined by the last price at which somebody was willing to buy it. There is no real-time chart for your home’s value. If there is a sudden drastic change in the value of your stock, you may worry a bit, like when you read the news about how your home value is stagnating. The danger is that a fellow stock owner can sell out of that investment as soon as they decide it becomes necessary. If a lot of people do that, now you have a plummeting stock value which can create even more uncertainty and more volatility. The tough part is that you can watch it happen in real time, and get caught up in the moment. It can be tempting to want to make a move, because you easily can.

So stocks are obviously the worst thing ever and you should stay away from them. Not quite.

Remember to focus on your goals. The purpose of this whole post is to figure out what to do with surplus cash, meaning extra cash that you don’t need at the moment. If you are not going to use it to pay down your mortgage faster, and you don’t need to spend it, you may as well put it to work for you.

Putting your extra cash into safe investments outside of your home (such as a low-cost S&P 500 index fund) can yield surprising results. As a long-term investment, the value tends to increase significantly faster than your mortgage interest rate costs you to carry your mortgage. As you compound your investment over time, you are entitled to more of that value increase. You just have to ignore the day to day price fluctuations, and focus on the long term trend of your investment.

Earlier I made the point that real estate is not a liquid investment, meaning you can’t easily exchange it for cash in a short time. Locking away cash out of reach can force you to take on more debt, when you need to access it. Liquid investments can be easily…well…liquidated, in the event of an emergency, without having to take on more debt that can impact your home. This is another benefit to keeping your money close, even if you don’t intend to touch it any time soon.

Investing in other investments puts your money to work for you. Rather than putting money into your lender’s pocket, you keep your money in your own pocket and earn the benefits. Yes, the volatility can be tough to watch and you can be tempted to want to pull out if real-time market data is scary, but statistically, doing nothing with your wisely invested money will yield an increase in value. The best example of this is…real estate! Real estate investments fluctuate just like stocks, but there is no real-time tracker injecting you with anxiety about the value changes minute to minute. The value only matters when you decide to sell it, at which point you would consult with an expert regarding pricing. Everything that happens in between is not your concern. In the first scenario, you would be putting money into your home where it would be hard to reach until the asset is sold. If you have the discipline to treat your alternative investments the same way, you will grow wealth in the long term. If your surplus cash is truly “surplus,” then you shouldn’t need to access it for a while, so don’t. If you can set it and forget it into statistically safe, long-term investments, your money should grow.

Meanwhile, your home value will also continue to grow. As the market value of your investments increases, so does your net worth. If your goal was to capture more wealth from your investment, then you are now riding the wave of capitalism to your goal.

Hard Numbers

Philosophy and goals aside, if you are weighing paying extra into your mortgage or investing elsewhere, you have to look at the numbers. Below is a chart comparing two scenarios, with conservatively estimated rates, and adjusted for a nearly identical cost basis at 5 years.

| Goal: Pay Off My Home Faster | Goal: Leverage Home Purchase to Build More Wealth | |

| Home Budget | $750,000.00 | $750,000.00 |

| Available Liquid Assets | $500,000.00 | $500,000.00 |

| Down Payment | (All Available Cash on Hand) $500,000 |

(20%) $150,000 |

| Interest Rate as of February 2022 | 3.89% | 4.06% |

| Monthly Payment | $1,181.63 | $2,895.22 |

| Extra Paid to approximate equal monthly payments between scenarios. | ($1715/m) $102,900 in 5 years. + | $0.00 |

| Extra Liquid Assets Invested into Index Fund. | $0.00 | $350,000.00 |

| Liquidity after 5 years (Assume 8% Annual ROI on relatively Safe Investments*) | $0.00 | $476,172.49 |

| Mortgage Interest Paid over 5 Years | $35,892.00 | $118,556.80 |

| Mortgage Principal Paid over 5 years | $126,534.41 | $55,156.28 |

| Home Value in 5 years (Based on conservative 8% average annual increase in value) | $1,020,368.00 | $1,020,368.00 |

| Amount Still Owed on Home Mortgage after 5 years | $112,328.00 | $544,843.72 |

| Equity in Home | $908,040.00 | $475,524.28 |

| Total Net Worth after 5 Years (disregarding housing expenses and taxes) |

$908,040.00 | $951,696.77 ($926,462.27 after paying capital gains from Index) |

| *S&P 500 Historically Averages 10.5% gain per year, excluding reinvested dividends. | ||

| +Would instead grow to $125,905 if invested monthly into same 8% investment as second scenario’s 1-time investment. | ||

| All calculations disregard taxes and inflation. |

In the first scenario, you throw all available funds towards the purchase of a home, and aggressively pay down the mortgage. The home increases in value and you realize that value increase in the form of home equity. The equity can be accessed by borrowing against it, such as in the form of a refinance, or by selling the home. Money paid into your mortgage goes towards the value of your home, but is in the pocket of your lender, where it no longer benefits you. Putting money towards your mortgage does not make the home increase in value any more dramatically than the market average, but it does entitle you to a larger share of the equity, when it is sold. You also save a bit, in interest, by reducing the principal on which interest is assessed.

In the next scenario, you purchase a home with a decent down payment, but invest the surplus into an Index Fund one time, then leave it to grow. While your home increases in value at the same pace as scenario 1, your Index Fund also gains value at the same pace (again, conservative estimate, as the stock market usually performs better than 8%, long term). The value of the Index Fund is more liquid, as it can be quickly sold to realize the gain, or borrowed against. The gains realized from your investment can be invested into improving your home, to increase the value more dramatically than average, without having to borrow more, and now you’re really cooking. The money in the Index fund is working for you, while the home builds equity in tandem. Despite paying more in mortgage interest, at a higher rate than scenario 1, you hold and leverage more assets at a higher rate of growth than what you are obligated to pay your lender.

Bottom Line

With today’s interest rates, throwing more money into paying off your house is not going to yield as much value as investing the surplus, in terms of net wealth earned. However, it may yield much greater peace of mind, and help you attain the life that you envision for you and your family, in the long run. Value is not always measured in terms of money.

At the end of the day, with an equal amount of cash available to you, your goals should dictate what you do. Nobody likes debt, but that feeling should not get in the way of making good decisions for your future. Debt and cash can both be powerful tools to leverage into wealth, if used intelligently.

If you have questions, please contact me. I’m happy to discuss investments, real estate, future plans, or just help you crunch your own numbers. If you have friends that can use my help, please send them a link to this website.

The Cooldown- Is the Sky Falling?

You may have seen the articles talking about the market cooldown that has been happening in our region… some more sensational than others. But, it’s all relative. While it is true that this is the slowest the market has been for the last 3 years, it is not the end of the world.

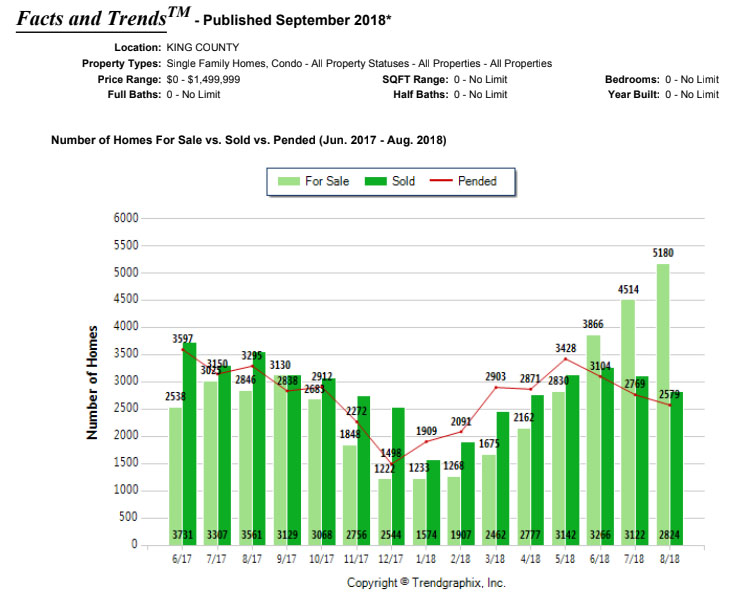

First, lets’s look at the data. The graph below shows the sudden increase in inventory. As of June, we entered a period where the number of homes for sale suddenly and dramatically increased over the number of homes sold. This followed a period where, since January, the number of homes going pending was far above the number of homes sold, which indicates that the inventory was being eaten up.

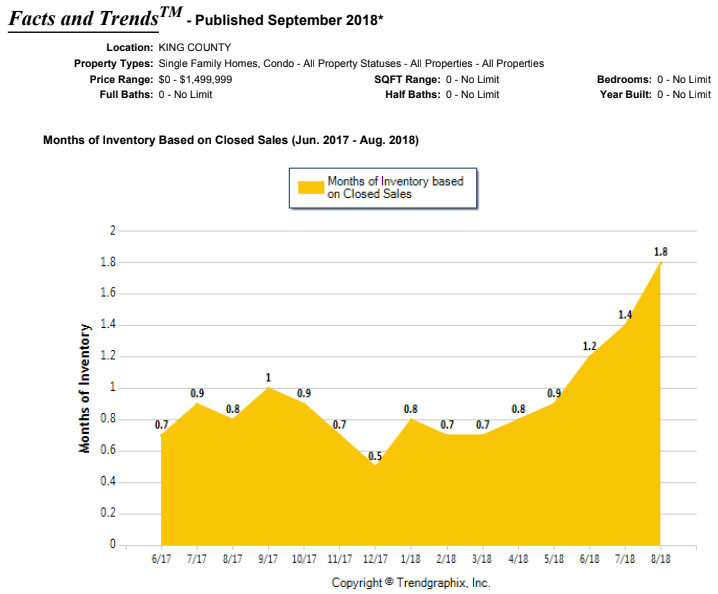

This graph looks scary enough to write a sensational headline, right? Now check out this graph of the inventory spike.

Also a pretty horrifying spike, there. This is a graph for King County as a whole. Specifically in Seattle, this is the first time that we have had over 1 month of inventory in 3 YEARS!

But, this is only part of the picture. The fact is, even this spike is WAY below what is considered a “balanced market.” Ideally, a market that puts buyers and sellers on an even footing would be around 5 months of inventory. As you can see, we’ve got a way to go before we hit that mark.

So why all the sensational headlines? Relatively speaking, this market feels incredibly slow. Until recently, sellers could list anything at a vaguely realistic number and expect to get at least one offer within a week. More often than not, property would be listed at a somewhat reasonable price, but would attract a hoard of buyers like moths to a flame. The competition would be fierce and the escalations in price would be extreme. My personal record was a home that I sold for $133,000 over my list price. No appraiser in their right mind would have let that slide, but the buyer paid all cash and had no contingencies, so the deal went forward. When this sort of thing happens every day, we all get used to it, and home values as a whole start rapidly increasing. Sellers started expecting that they could sell anything for a massive escalation, by simply listing it, regardless of price.

So what happened? Among my colleagues, we’ve discussed many possible reasons for the sudden change. It’s a combination of rising interest rates putting the squeeze on buyer budgets, the sudden increase in inventory that is apparent in the graphs from above, and a healthy dose of Buyer’s fatigue. I also believe that market timing has contributed.

From January until May, sellers were watching prices skyrocket and were ready to get in on the action. Knowing that the hottest season for buyers historically starts when school ends, they took their time to prepare for their home sale, and tried to time it for a June listing. In this period, sellers were ready to go, but were sitting on their property until they could capture the most buyers and win one of those hefty escalations. Inventory stagnates at an extremely low point for these few months, further frustrating buyers with a lack of listings to choose from, and an excess of competition for the ones that are available. June rolls around, and the market is “flooded” with more listings, which would hopefully be a boon to the market activity. Unfortunately, right around that time, the Fed raised interest rates for the third time this year. Buyers that were struggling with what little inventory was available up until that point, now had a harder time qualifying for the homes that were suddenly available. Assuming that they were knocked out of the competition, or feeling like they simply didn’t want to deal with the hot season buying frenzy, the buyers backed off. More inventory floods in, but the buyer fatigue is still in the air.

For June, it felt like the floor had fallen out on sellers, but the market had really just cooled off a bit. Buyers that were still out there were suddenly winning offers with inspection contingencies and no escalations! Some sellers increased their list prices because they had tried listing below market value to attract attention, only to get one offer at their list price. The old strategies weren’t working as well anymore.

Currently, the buyers that are still actively looking, are snagging some deals that feel incredible compared to what they were expecting leading up to the “hot season.” I have encouraged a few of my own buyers to get off the bench for this moment.

Competition and escalations are still out there. Sellers are still selling for high prices. It’s just that buyers can afford to be a little more picky right now. Personally, it’s been a welcome reprieve to my business. I get to do more data analysis and strategizing with my sellers, and I get more negotiating room for my buyers.

So, while it’s true that we are in a slower period, we still have a long ways to go before we can call it a crash. Housing shouldn’t be looked at as a commodity, either. Real estate is historically a very stable investment that, at its absolute worst, will still beat inflation over the long-term. Maybe the flippers and speculators are backing off due to the uncertainty month-to-month, but the smart buyers looking for long-term stability and the smart sellers sitting on a mountain of equity are still out there making the deals happen. As long as we have both, the market is still going to keep moving.

The Hard Truth About Seattle

The Good, The Bad, The Alternative

Heads Up! This is not going to be the most happy post you read today, but I feel like it’s a necessary bulletin at this point. I have numerous clients that feel like they can’t afford Seattle prices and have simply given up. This is mainly for them.

The Bad

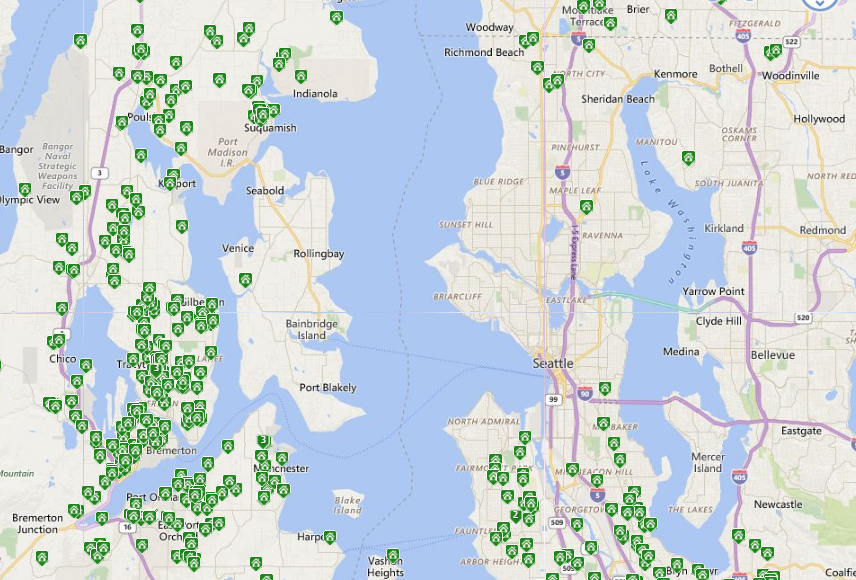

This is the current map of available residential homes for sale in the Seattle area that are listed below $350,000. It looks much the same at $400,000.

Before you look at that map and take the wrong lesson from it, that one listing in Ravenna is a bankruptcy short sale with over $20,000 in fees that must be paid in cash. It’s been on the market for over 300 days. It is not a sign of activity in this price range.

To my many demoralized clients that are looking in that big empty space for a residential property in this price range, this post is not meant to depress your further. I just want to illustrate the hard fact that Seattle home prices in these areas have surpassed your budget. I’m still trying to find places for you, but the hard truth is that it’s time to consider alternatives. Prices will not be dropping any time soon.

The Good

Real estate prices in the entire region are on the rise. The world is much bigger than Seattle. If you can afford to borrow $350,000, then I can find you a property. Interest rates are low right now. Once you’ve locked in an investment, you will likely start realizing instant equity growth.

This is an excellent way to build wealth. Waiting for prices to come down is not a winning strategy. Before homes become affordable, rents will increase and squeeze out people that can’t afford them. Eventually it will put the squeeze on you. People will be moving further and further from the city trying to chase cheap and unstable rent.

Now, imagine you own a property just outside of Seattle. Flash forward to a likely scenario of next year, when rent and home prices have increased even more than today, and interest rates have possibly increased just a little bit, making it slightly more difficult to purchase a home. More people are going to be moving out of the city and trying to find something more affordable nearby. You, the homeowner, stand to profit off of this squeeze. Not only will the equity in your home increase, but you will likely be able to rent your home for a price that pays your mortgage and gives you a little bit of spending money on top of that. Maybe that little extra bit of cash is enough to help you afford to rent in Seattle. Either way, your investment is paying for itself and equity is building. Down the road, you may be able to refinance or sell your property at a high enough profit that you can now afford a home in Seattle. This is fundamental Real Estate investing.

The Alternative

You don’t even need to set your sights that far from North Seattle. Look at that map again. Notice that just below Downtown Seattle, we start seeing some listings in the $350k price range. South Seattle has better transit options that North Seattle, and they are getting better all the time. If you want to live in a home you own, and you still want Seattle, consider where the Light Rail runs.

Take it from me; everything that you like about North Seattle can be found in South Seattle. I lived in Ballard for 5 years, and have lived in South Seattle for the last two.

So, why isn’t it more expensive? Often, people cite more crime as a reason to avoid South Seattle, but this is a stigma. South Seattle today is very different from the South Seattle of two decades ago. Capital Hill, one of the most desirable neighborhoods in the city, has much more property and personal crime, on average, than say… Beacon Hill. Overall, though, Seattle crime is low when compared to other cities, so you can’t really go wrong. You can usually tell if an area is bad by how it makes you feel to stand in it. Trust your instincts.

Anyway, South Seattle is just one of many options. If you’re looking for an investment property to get your foot in the door of the real estate world, consider where the jobs are. Consider the paths that commuters take to get to those jobs. Have you considered Des Moines? Renton? Shoreline? Lake Forest Park? Where do people need to live to be near what they want?

Conclusion

I know it’s frustrating trying to buy property in Seattle, especially if you can’t afford the area that you want. If it’s important to you, it’s not a good idea to wait for market conditions to get better. Market conditions are as good as they are going to get for buyers for the foreseeable future. Interest rates are not going down, and prices are only going up, so it’s important to strike while you’re willing and able.

I’m here to help. If you’re curious about buying here, you want the knowledge of somebody that’s been living in the trenches of this crazy market for the last few years. I know how it works and I know how to make it work for you. Give me a call, shoot me an email, or invite me to happy hour, and I promise I can help set you on the right path.

Finally, I know that I didn’t really discuss the condo market, which is very different from the residential property market. I may post something about condos in the future, but most of my current clients are looking for residential homes, so that’s where my mind is at the moment.