The Home Buying Process

A guide outlining what you can expect when working with me to help you buy your home.

You’ve Decided to Buy A Home

This is an exciting decision and may be the largest purchase you will ever make! It is important to know what to expect along the way. This page is meant to be a comprehensive guide to the process of buying a home. While every transaction is different, this should give you a basic understanding of what you will need to do and what you can expect of me as I help you navigate the complexities of a real estate purchase transaction.

Services and Expertise

This is what I bring to the table as your real estate representative. As a professional full-time real estate agent, I bring a premium level of attention and service to my clients. Below is a brief outline of what you can expect from me.

Tailor Made Search Strategies Depending on Your Needs

My recommendations are tailored to your situation, and not just a “one size fits all” formula.

Negotiation

I am a Master Certified Negotiation Expert. That’s really just a fancy way of saying, “I know how to assert your needs.” You can expect me to fight hard to get you what you want from the purchase of your new home.

Black Book and Task Management

A real estate transaction requires collaboration. As you do your due diligence to investigate your investment, you can expect to rely on the help of experts that specialize in each aspect of the transaction. I have a network of people that I trust to deliver the high quality, full service that I advertise. I maintain relationships with reputable inspectors, title agents, lawyers, lenders, and a whole network of contractors that we can call to assist us with your deal.

Knowledge

What I know works for you. My brain is my tool that I share with you, and I keep my tools sharp. The contract I write, and the negotiation that I do on your behalf, will serve you well.

Lending

In addition to being a Real Estate sales agent that can help you with negotiating your purchase, I am also a Mortgage Loan Originator that can help you qualify for a home loan. This is a rare service that most other real estate agents do not offer, as it requires a separate license and more education to do both. Check out the financing page or skip to the Budget and Buying Power section of this page for more information.

Market Evaluation

Sure, you can look at the list price of a house, but I’ll go further and actually measure its value with fresh market data. I use the same methods that appraisers use to verify a homes value. I want to show you that a home you are interested in is worth the price you will pay for it.

Presence

I will be by your side every step of the way as you navigate the market. I will be there to lend my trained eye to your in-person property showings. I also attend inspections and final walk-throughs with my clients.

Communication

You will not be left in the dark. I’ll be sure you know exactly what is happening with your transaction as it progresses. We can establish a regular communication schedule, or I can just let you know when certain milestones are hit. The more you know, the less you have to stress. This also goes for coordinating with contractors and other parties in the transaction.

What to Expect

Here’s what to expect from your home buying experience:

I’M HERE TO HELP:

• Prioritize your needs and wants

• Find and analyze homes that fit you

• Negotiate the best terms for you

• Walk you through the entire process from touring homes to closing on ‘the one.’

Throughout the process, I am just a call, text, or email away.

Prioritizing Your Needs and Wants

From the beginning, this deal is about you. I want to be sure you are finding what you need, and that I am doing the right things to make those needs come to fruition. This is the basic criteria that I use when narrowing down your home search. However, as I stated earlier, my services are tailored to you. So, if there are other specific things you need from a property, that doesn’t fall into these basic categories, let me know. I can get surprisingly specific with my search. This is just a start:

PROPERTY TYPE:

Single Family/Townhouse/Condo

LOCATION:

Where do you want to be and for how long?

COMMUTE:

- How far are you willing to commute?

- Is your work location likely to change in the near future?

DESIRED FEATURES:

- Interior and Exterior Square footage

- Number of beds, baths

- Layout: two-story/rambler/split entry…

- Maximum Age of Home

- Garage attached/detached/carport/street parking

SCHOOL DISTRICT:

Is this a priority?

PRICE RANGE

What is your max price and your comfortable price? They may be different.

DESIRED MOVE DATE

What are your logistical limits or needs? Will you need to rent for a little while?

DO YOU HAVE A HOME TO SELL FIRST?

Does it make sense to sell before buying? Will you need a bridge loan?

10 Point Buying Process

Below is is a general outline of the process. Since each transaction has its own set of unique variables, your process may include more or fewer steps.

1) Get Pre-Approved or Pre-Qualified

It is important that you know what you can afford. If you are not paying all cash, then you will likely need a home loan. I am a Mortgage Loan Originator myself and I know other lenders that I trust and recommend to my potential buyers to help them finance their purchase. If you are already talking to a lender, please be sure to let me know who they are and how to contact them so that I can communicate and coordinate with them directly.

2) Determine Your Desired Outcome and Needs

Are you a first-time home buyer with a growing family? Are you an investor looking for a flip? Are you relocating to an unfamiliar neighborhood for a job? Do you need a place to park an RV? I will meet with you to determine the criteria for your home search. The more specific you can get, the better the results I can return.

3) Home Search with Regular Reevaluations of Number 2

Many people want to skip ahead to this one because it’s fun! However, it’s important that the previous steps happen first. We will go out and evaluate properties in person, then re-compare them to the search criteria we’ve been using to see if we’re missing any critical features that you are seeking.

4) Narrow/Specialize the Search

Now that we’ve found some properties that we like, it’s time to narrow them down. I access MLS records and other public information to see if any of the properties show any immediate red flags. I also compare them to each other to reconcile the best value and perks for the price and terms. Finally, I will present these to you for your final evaluation. If nothing strikes your fancy, then we repeat steps 2 to 4 until we have zeroed in on a winner.

5) Find “The One” and Determine an Offer Strategy

“We’ll take it!” Not so fast. It is important to act quickly, but every offer requires some level of strategy. We will think critically about the property, and come in with the strongest offer we can muster. Since this is likely one of the largest purchases of your life, we will be careful to make sure that our strategy fits within your risk tolerances. This is not the time to make hasty or reckless decisions.

6) Write the Offer

I will write up the offer and summarize it for you. You will get a chance to read it and ask questions before you sign it and I submit it to the sellers. I will not send the contract off until you understand and are satisfied with what it contains.

7) Negotiate With the Seller to Get the Offer Accepted and Signed

Sometimes just sending off a pile of papers to get signed is not enough to grab the attention of the seller. As enticing as a big number on a sheet of paper can be, sometimes the seller just wants to know that the offer will close without issue, and the buyers are truly prepared. I will assure them that this is the case and provide proof of our preparation as requested. Sellers often go for more favorable terms with trustworthy people, over a high purchase price with more risky terms. If the seller requests revisions to the offer, I will discuss the revisions with you and negotiate on your behalf. I will be your advocate until closing.

8) Due Diligence with Regard to Evaluating the Property for Flaws

There will most likely be some kind of inspection. If we conduct our own, I or one of my associates will be there for the inspection, and you should be present as well. Inspection reports are dry and blunt. Inspectors often provide additional informal insights to people that are present for the inspection. Having a conversation with the inspector can help clarify the findings of the report.

Due Diligence is not limited to home inspections. Depending on how the contract is written, there may also be a title report, survey, or other specific item that we must investigate prior to closing.

9) Appraisal

The lender will order an appraisal on the home. This happens for a few reasons. This is different from an inspection. The appraisal is often required by the lender to verify that the condition and value of the home is suitable for the loan you are applying for.

10) Closing & Possession

Escrow will collect the money for the deal, and have you sign the paperwork that transfers the property from the seller’s name to your own. You will also receive Title Insurance. Once both the buyer and seller have signed everything, escrow will disburse the money for the transaction to the proper parties and you may take possession of your new property. I will make sure you get your keys.

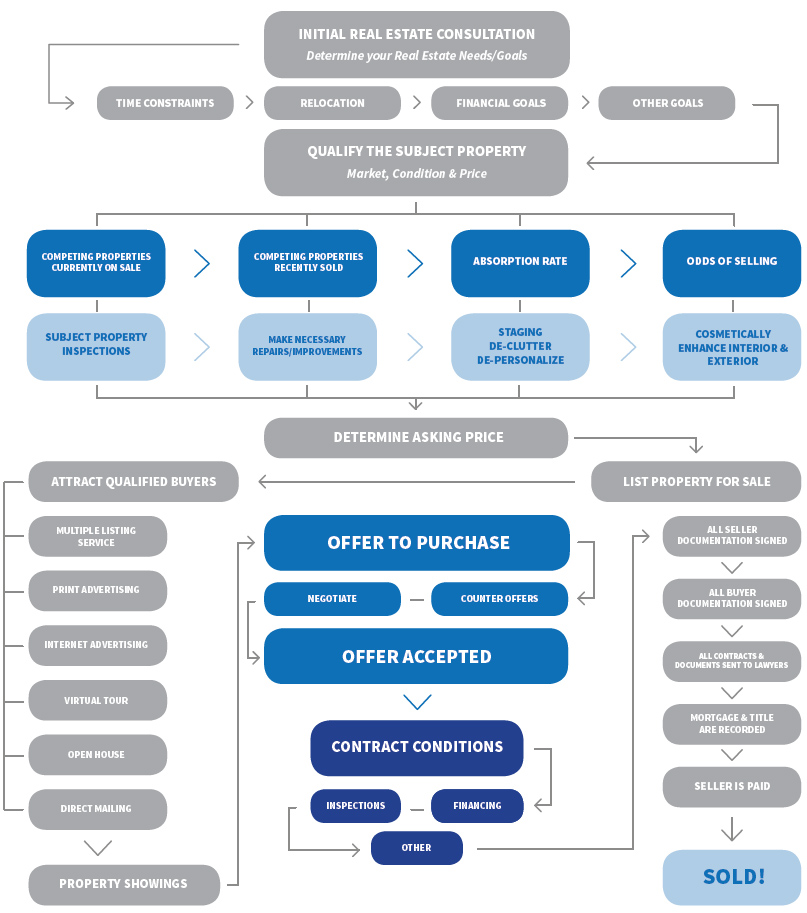

Typical Real Estate Transaction Flow

Budget and Buying Power

The pre-approval process, which entails review of financial documentation and a credit check, is the best way to determine the home buying budget that is right for you. Early in your search, you can identify any potential hurdles and focus only on homes that fit your desired price range. It’s a good idea to talk to a lender before you identify a property, because it takes time to get Pre-Approved.

PRE-QUALIFICATION

This is an unofficial estimate of how much house you can afford. A Mortgage Loan Originator will calculate how much they believe you can qualify to borrow based on your verbal or written submissions of income, finances, and credit history. While this is the starting point to getting proper financing, a pre-qualification is inadequate proof of your ability to get a loan to purchase a home. It is simply an educated opinion from your loan officer. Pre-qualificaiton can be an excellent way to ballpark your budget and see if you are ready to apply for a loan and begin the subsequent home search. If your MLO discovers any snags with your finances, they can advise you how to remedy the situation to better your borrowing position.

PRE-APPROVAL

In order to obtain pre-approval for a loan, your Mortgage Loan Originator must provide your lender with documentation including pay stubs, W-2’s, bank statements, and other asset verification. They will also run your credit. Your lender will analyze your income, assets, and debts, then produce a pre-approval letter that certifies you have the resources to buy a home up to a particular price point. You also have the option of being “pre-underwritten” before pinpointing the specific property you are going to purchase, which is an extra layer of confirmation that you can indeed afford to borrow up to your proposed price point. Sellers will want to see that you are at least pre-approved, and will look even more favorably upon being pre-underwritten. Your Mortgage Loan Originator should be able to draft a Pre-Approval Letter for you after receiving pre-approval from your lender. That letter is usually submitted along with our offer. This is why it is important to get pre-approved BEFORE we identify a potential property.

CHECKLIST FOR LOAN APPLICATION

The list of items you need for loan application may include the following. Your lender may ask for more items that are not included on this list.

Income

- Two months of recent pay stubs.

- W-2 forms from the past two years.

- 1099s from the past two years.

- Current Bank Statements from all checking and savings accounts.

- Statements for all Investment Accounts, including:

-401Ks

-IRAs

-CDs

-Brokerage Accounts - Life Insurance Statements showing accumulated cash value.

- Down Payment Gift Letters, if you will be receiving gift funds as part of the down payment.

- Alimony and child support info.

- If Using Investment Property Income:

-Documentation proving rental income.

-Copy of Lease.

-Property Appraisal Report, or at least an opinion of value. - If Self Employed:

-YTD Profit and Loss Statement.

-Documents to show unpaid accounts receivable.

-2 years of tax returns.

Debt

- Company Name, Account Type, Account Number, Unpaid Balance, and Monthly Payment for all liabilities.

- Any paperwork that documents monthly child support or alimony you provide.

- Proof of job-related expenses, if applicable.

- Statements of balance for:

-Credit Cards

-Student Loans

-Personal Loans

-Auto Loans

-Medical Bills

Other

- Copy of Driver License front and back.

- Property addresses and accounting for investment properties, especially if refinancing.

- Exisiting loan info and whether or not the loan will be paid off at closing.

-Monthly Payment

-Unpaid Balance

-Credit Limit

-Type of Loan

-Lender Name and Account Number - Social Security Number for running credit report.

- Other specific documentation requested by Underwriter.

I am a licensed Mortgage Loan Originator in the State of Washington. Click here if you would like my help with financing. Even if I am not the right lender for you, I can probably connect you to somebody who is.

Comparative Market Analysis (CMA)

Listing agents use CMAs to determine a good price at which to list a property. Buyer’s agents use CMAs to determine if the list price is fair, and to determine a reasonable price to offer for a property that their client wants to purchase.

The market value of a property is commonly determined by comparing it to the value of other homes that have recently sold in the area, or are currently listed on the market. Valuing a property is an art and a science.

THE SCIENCE:

Using local MLS listing information and property tax records, I can find comparable homes by number of bedrooms, bathrooms, square footage, lot size, and an untold number of additional features. Then, using the information about how much those homes have sold for, or are being listed for, I can get in the ballpark of a property’s fair market value. Most online valuations stop here, but only an experienced agent can take it further.

THE ART:

Decisions must be made about how to adjust the value of the comparable homes as their features compare to the subject property. Adjustments must be made and values must be added for stand-out features based on their desirability or utility in that market. For example, if the subject property is the only one on the block with a garage or a view of the water, then a value is assgined to those features and added to the comparable property values to better compare with the subject property. Fewer adjustments make for more confident opinions of value, but almost every CMA has some adjustments since every property is unique.

In order to be as accurate as possible, your agent must see the listing in person to evaluate its condition, and get a sense for how it fits into the neighborhood. By drawing accurate conclusions from an accurate set of data, your agent should be able to provide an accurate opinion of value.

The CMA is not the only determining factor for what you will ultimately offer. It is a tool that helps us predict and adapt to what the market is doing and arrive at a likely outcome. I like to tell my clients that we write offers according to their level of enthusiasm. If the subject property is the dream home, then we may be more aggressive than if we’re buying a “take it or leave it” investment property.

Note:

The CMA, as you can see, requires a lot of technical experience, neighborhood knowledge, and critical thinking on behalf of your agent. A poorly executed CMA might compare the subject property to other properties that are not similar, or it might draw the wrong conclusions from the data.

Inspection

Buying a home is one of the single largest investments you will make in your lifetime. To minimize unpleasant surprises and unexpected expenses, you need an objective, detailed examination of the physical structure and systems of the house, from the roof to the foundation.

A HOME INSPECTION GENERALLY COVERS:

• Exterior features: walls, roof, decks, chimney, drainage conditions, etc.

• Interior items: windows, plumbing, electrical panel, appliances, heating/cooling systems and big ticket areas like the crawlspace, foundation and attic

• Structural pest inspection

ADDITIONAL ITEMS TO CONSIDER GETTING INSPECTED:

• Sewer scope or septic inspection, if applicable

• Lead-based paint and Asbestos contamination for homes built before 1978

• Oil Tank Location

• Mold and/or Methamphetamine Tests

NOTE:

Ask your real estate agent for recommendations for a quality, licensed inspector, who will provide a detailed report with digital photos. A quality inspection will give you confidence to move forward with an informed decision.

Appraisal

An appraisal is a comprehensive look at a home’s location, condition and eligibility for federal guarantees. For example, a home that doesn’t meet safety requirements, such as handrails on steps, will not be eligible for FHA or VA loans until the handrail is installed or repaired. Appraisers are members of the MLS, like real estate agents, but they must abide by additional guidelines that minimize risk to the buyer’s lender.

When the appraisal is finished, the lender will verify the appraiser’s opinion of the home’s value. They may also require the seller to fix certain items before proceeding toward closing. If the property doesn’t meet the lender’s parameters, the lender can decline the loan. Although stricter lending practices have been implemented over the last decade, this has resulted in improved appraisal standards. Most buyers’ loan applications result in a successful closing.

NOTE:

A good agent can protect you by recognizing qualities in a home that may become appraisal concerns, prior to writing the offer.

Submitting a Strong Offer

I WILL ADVISE YOU REGARDING:

• Market climate, timing, pricing, and strategy

• Potential for multiple offers and strategies to successfully compete against other buyers

• When applicable, an action plan to strengthen your offer, including pre-inspection, altered contingencies, earnest money, closing timeline, seller rent back, or more

ONCE AN OFFER HAS BEEN ACCEPTED BY BOTH PARTIES, I WILL:

• Keep you updated on all time-lines and milestones

• Keep track of all contingency due dates and expiration dates

• Order title and escrow and assist with earnest money deposit

• Stay in close communication with your lender to ensure a smooth closing

• Advise and represent you in all further negotiations

• Facilitate all appointments

• Ensure that contractual deadlines are met and your overall experience is as smooth and enjoyable as possible

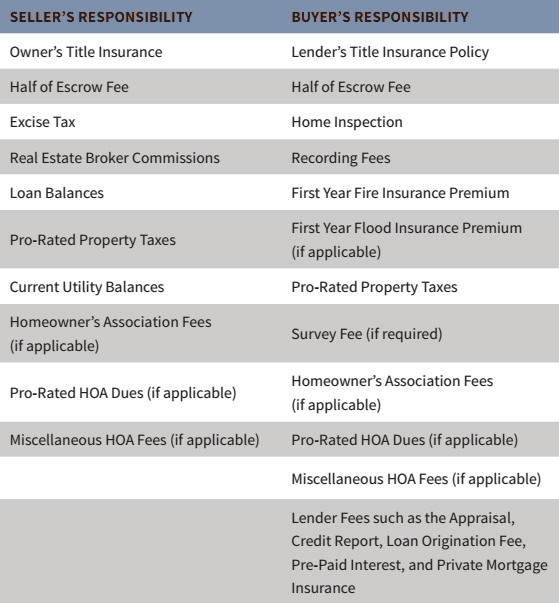

Closing Costs

These are the customary fees associated with a real estate transaction, and who typically pays them.

Frequently Asked Questions for Buyers

What is a Buyer Agency Agreement?

A Buyer Agency Agreement is a contract between a buyer and a real estate agent. The Buyer Agency Agreement lays out the commitments of the buyer to the agent, and of the agent to the buyer. I use Buyer Agency Agreements in my business. You can expect to be asked to review and sign an agreement with me after a brief trial period or if I draft an offer for you. It makes our working relationship official and protects us both from wasting our time or resources throughout the buying process. Rules regarding Buyer Agency Agreements have experienced numerous reforms over the years, so even relatively new public information may be outdated. As an agent, I am often briefed about the latest changes. I am happy to discuss these agreements in more detail with you at our initial orientation meeting.

What type of information will my agent need from me?

To do the best job for you, I will need the best, most complete information you can provide. This would include things such as:

-the name of your lender

-preferred price range

-number of bedrooms / bathrooms

-minimum square footage desired

-style of home (single-story, two-story, etc.)

-preferred school districts

-geographical areas / neighborhoods of interest

-special needs / special interests which your home needs to accommodate

Keep in mind that a very specific set of criteria may narrow your list of potential properties, while a very broad list may lead to an overwhelming number of properties to view. You’d be surprised at how specific the search criteria can be.

I will also need complete contact information from you. At the very least, your full name (spelled correctly), your phone number, e-mail address, and current address.

How can I find out about new properties?

These days, most property searches start online. At the monent, Redfin is the best consumer option for searching on your own.

I use the Northwest Multiple Listing Service, which is the database that all of these other sites pull their information from. Some of the information I can see on the NWMLS is only available to me as a licensed broker, and will not show up on a public search that you do on your own. It’s also a good resource for finding important documents.

I can send you regular e-mails from the MLS, and even set up automatic e-mails that will send you new listings that match your criteria, so you see new properties as soon as they are listed!

If you do like doing your own searching online, just remember to send me what you find, so that I can check it out on my end.

After we narrow down an itinerary of potential properties, I can set up the appointments to go check them out in person.

Can my agent provide information on properties listed with other companies?

Absolutely. I am not just limited to listings from my own brokerage. The Northwest Multiple Listing Service is a combination of all the listings provided by all of the real estate firms that operate in its service area, which is most of Washington.

Can I go to open houses without my agent?

I would prefer you let me know if you want to see any property, even if it is hosting an open house. Don’t be afraid to put me to work. You benefit greatly from having my trained eye to help you evaluate properties. That said, you can go to open houses without me. When meeting an agent hosting an open house, it’s best if you immediately identify yourself as working with another agent. It’s good etiquette, and helps avoid some nasty conflicts and confusion if you decide to submit an offer on that home.

Can I work with more than one agent?

Nothing is more frustrating to an agent than a buyer who is working with multiple real estate agents. In this situation, there is no guarantee that I will be the agent that ultimately helps you write up an offer and be compensated for my job well done. I avoid these situations because I would not, in good conscience, be able to provide you with the best quality of service if I am not sure that I will be respected or compensated for doing my best work. Buyer Agency Agreements protect both of us from this conflict.

However, there is an exception. If you are looking at properties in a geographic area that is very far from me and I have no knowledge about, then you can ask me for a referral, and I can find an agent that would be better suited to help you in that area. I will let you know if a property lies out of my territory or area of expertise.

What if I am unhappy with my agent?

First and foremost, let me know. It won’t hurt my feelings…unless that’s what you’re trying to do (which is not constructive). If I am not providing you with the service you expected, then tell me what else you need. Criticism is the only way I can get better, and I welcome it. If the issue with me is more substantial, and I am simply not “the right fit,” let me know and I can provide written cancellation of the Buyer Agency Agreement. However, I ask that you please be patient with me if it doesn’t initially seem to be working out. I’m flexible, and quick to adapt, but I’m also human. Sometimes it might take a few tries to narrow down your needs and start off down the right track. I want to help you find what you are looking for just as much as you do.